The financial services industry has its digital CX priorities in order (for the most part), according to Mopinion’s recently published Digital Customer Experience Benchmark report. In fact, lined up closely with the ecommerce and travel industries in terms of its survey results, the only industry that performs higher is software and technology.

What’s particularly interesting to see with this industry is the high level of attention paid towards the collection of feedback data. To illustrate, a whopping 80% of financial organisations gather feedback. What’s more, they monitor their digital customer experience with this feedback just as closely as they do with offline experiences; a trend which isn’t necessarily dominant among other industries surveyed.

But what about the stages following data collection? How often do these financial institutions actually take action and act upon insights they’ve gathered? And just how successful is this industry overall?

The benchmark measures all facets of the digital experience management process (including management and mastery), so let’s explore what this year’s report reveals about the financial services industry in 2023.

But before we get started, let us explain how Mopinion’s Digital Customer Experience Benchmark measures these efforts.

The Digital Customer Experience Benchmark

The Digital Customer Experience (CX) Benchmark 2023 report is a report generated by Mopinion based on extensive survey research within the global market. It measures the level of activity around digital CX among organisations all over the world using three main dimensions: Measure, Manage and Master.

The Measure dimension zooms in on how organisations collect feedback via digital channels such as websites and mobile apps.

The Manage dimension measures what organisations do with the collected feedback. In other words, to what degree organisations analyse and report the feedback within their team or to the board.

The Master dimension measures how well organisations take action on their feedback (to improve the organisation on a continuous basis).

*With a focus on the digital side of customer experience management, the benchmark does not include any data about ‘offline or traditional’ customer experience initiatives. It refers solely to the activities that take place across digital channels and touchpoints such as websites, mobile apps and email campaigns.

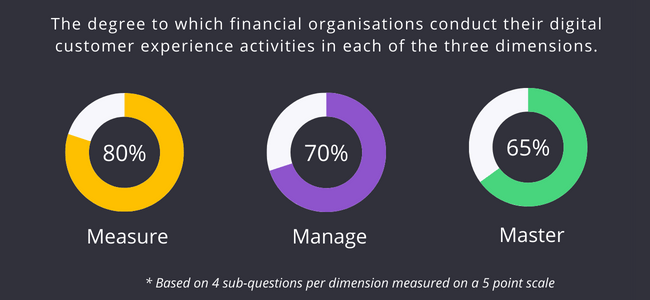

Average Scores Per Dimension

Curious how the financial industry scored overall – across all dimensions? Here’s a quick glimpse.

Similar to the ecommerce industry, organisations in the finance industry score quite high in the ‘Measure’ (80%) dimension. Not surprising… as we see more and more financial apps sprouting up all over. Hence the need for a competitive digital customer experience.

However, it’s a bit troubling to see that as these organisations move to the next stages ‘Manage’ (70%) and ‘Master’ (65%), the scores seem to drop. So the question is…which areas – within these dimensions – are finance organisations failing to succeed in exactly?

Let’s take a closer look at each dimension individually.

Best Practices for Financial Companies entering the Digital Age

Meet rising expectations with these tips!

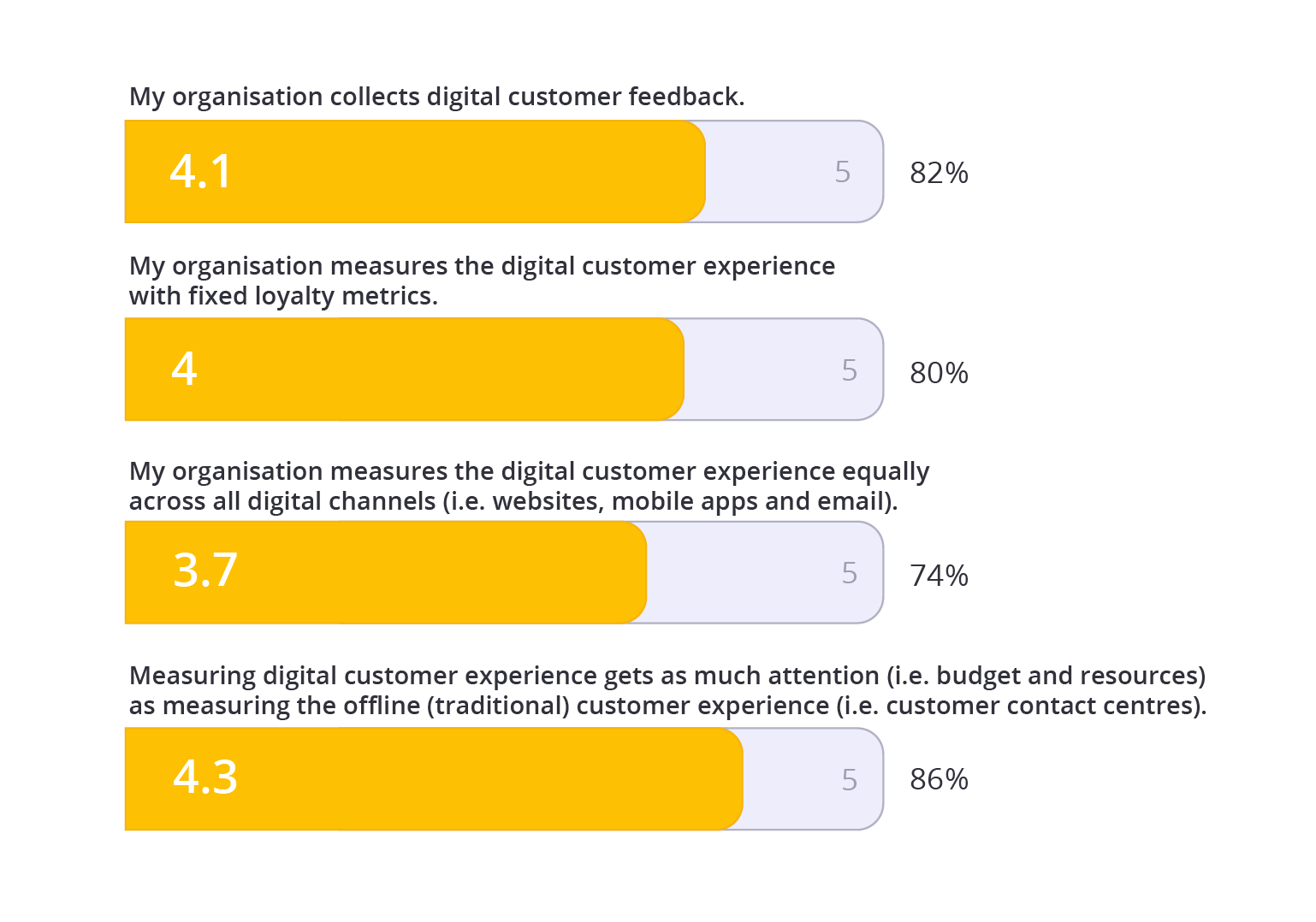

Measure

The outlook for measuring the digital customer experience looks promising. With 82% of organisations surveyed already collecting digital customer feedback, it’s clear that the industry recognises the need to listen to online customers.

What’s unique with this industry, however, is that compared to the retail industry (which scored a 70% in the Measure dimension), the financial services industry has really made efforts to prioritise the digital experience. To illustrate, nearly 86% of companies shared that they put just as much attention towards the digital experience as offline experiences.

If we look at financial institutions such as banks – in particular – this is an especially significant and dominant trend. Many experts believe that the ‘future of customer relationships is going to be a hybrid of digital and in-person services’ which drives this trend even further.

The banking industry is undergoing massive digital disruption, with online deposits, mobile apps, and e-bill payments fundamentally becoming the norm.

Manage

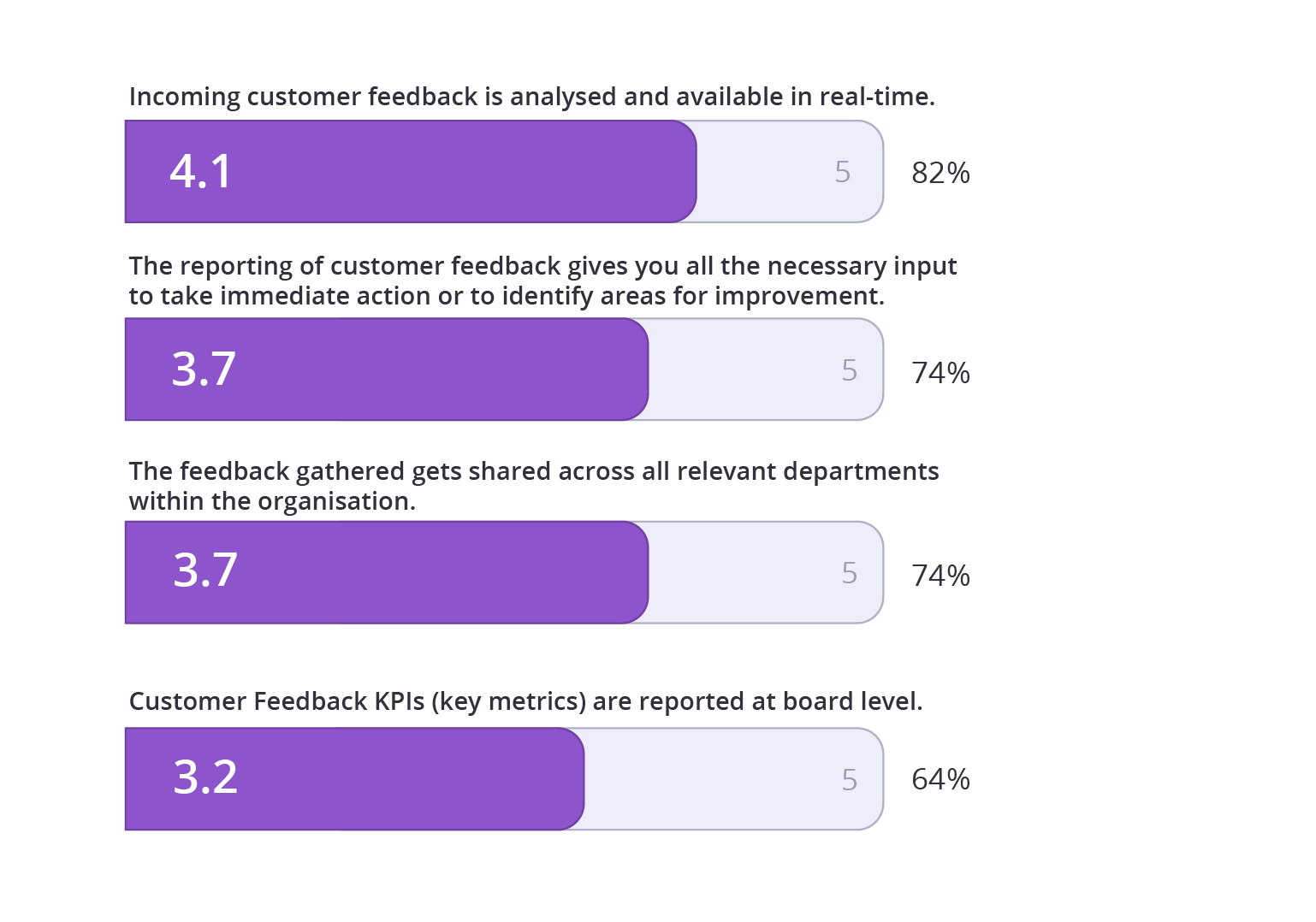

But then the industry hits a bit of a wall. According to the results from the Benchmark survey, they are – for the most part – successfully analysing their incoming feedback. However, taking that data and doing something with the insights isn’t happening as much as it should. Especially if we look at how many organisations are already making the effort to gather the data in the first place.

And then of course, there’s the residual 36% of organisations that are essentially siloing this data rather than sharing important metrics with other departments or at board level (where the biggest decisions are being made).

What can this be attributed to?

One explanation could be that because many financial organisations are taking the ‘hybrid approach’ (focusing on both online and offline interactions simultaneously), there is some sort of disconnect that arises. In other words, they have behavioural data from both sources, but they don’t know how to bring these two data types together.

It could also be a lack of prioritisation, in general. Cross-departmental cooperation and involvement is required in order to be successful in the ‘Manage’ stage and if not everyone (or every department) is on board with the initiative, it will fall flat.

Ready to optimise the online journey for your financial institution?

Check out these tips and tricks!

Master

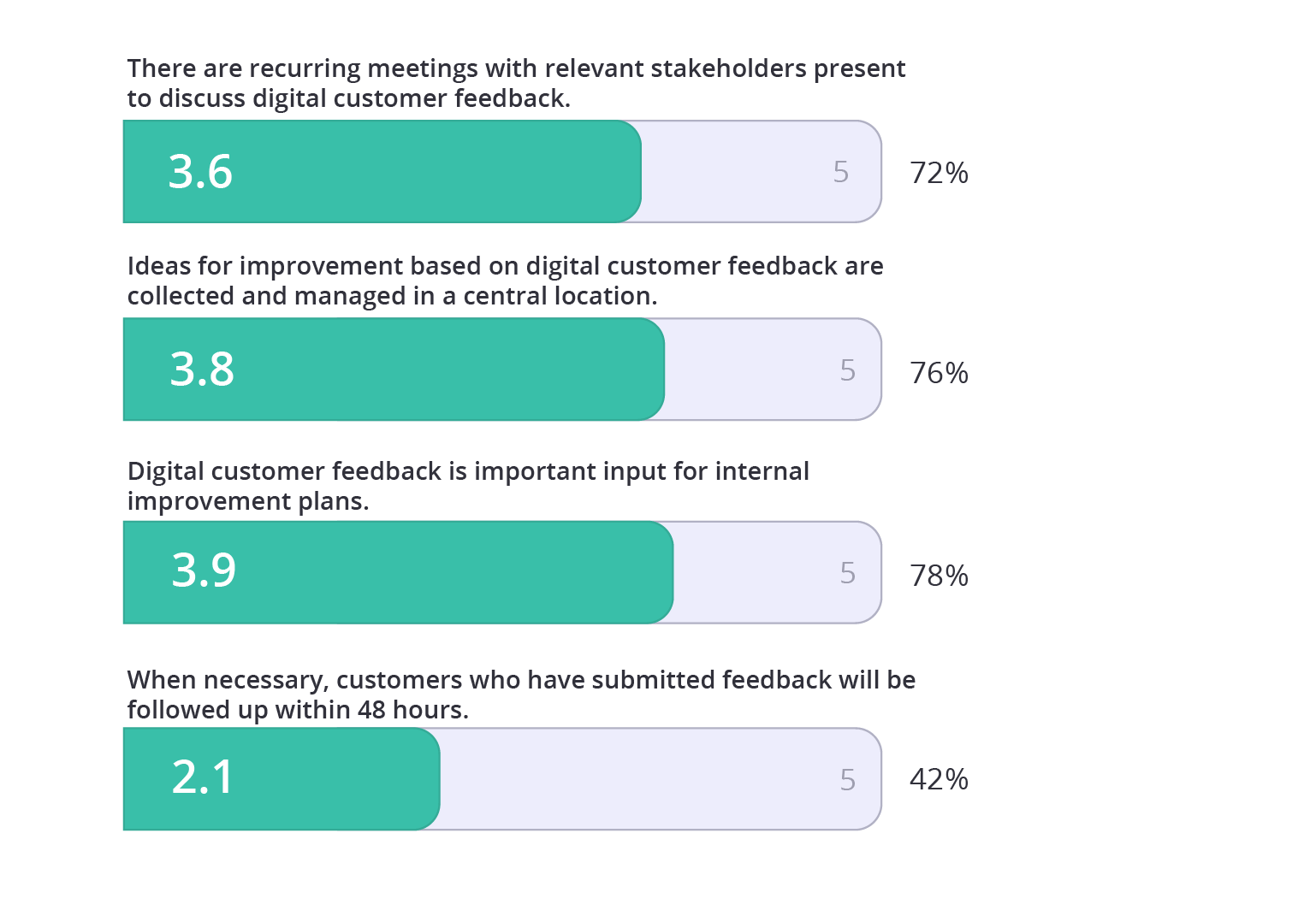

And then there’s the lowest scoring dimension of all three: Master. The Benchmark report shows that the financial industry appears to be depriving itself of a good follow up process. Only 72% of organisations hold regular meetings with stakeholders to discuss feedback.

And then perhaps the most concerning results: less than half of these organisations (42%!) are following up on customer feedback. Meanwhile the best way to give your customers a positive experience is to incorporate proactive communication. So if these organisations are failing to do that, they’re also failing to engage and make customers feel valued.

According to Apptentive,

Simply interacting with customers, proactively and respectfully, can increase three-month retention by as much as 400%

Therefore, this really should fall higher on the list of priorities for financial organisations.

This trend also emphasises the need for a feedback software with a strong analysis and follow up solution.

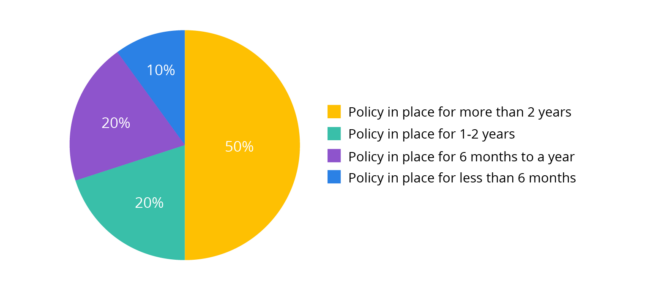

How many organisations already have an active Digital CX policy in place?

It’s great to see that 70% of organisations have had a policy in place for at least a year or more. Whether this policy was brought on by the corona crisis or another trend in the finance industry, it’s good news for customers of financial institutions. It means that their needs are being brought to the forefront and that the digital customer experiences across these organisations will hopefully continue to improve.

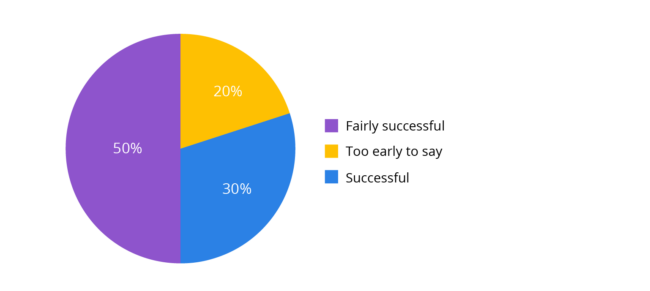

How successful is the financial services industry in terms of Digital CX?

Fairly successful, actually! At least that is how they see it. A whopping 80% of respondents said that they were ‘Fairly successful’ or ‘Successful’. This indicates that the majority of finance organisations are quite content with the way in which they are handling their feedback data.

Key Takeaways for the financial services industry in Digital CX

- A huge chunk of organisations (86%) are gathering feedback, but poorly managing the data.

- Many finance organisations are likely taking a hybrid approach to customer experience, with efforts in both traditional and digital channels.

- A fair amount of organisations are analysing the data, but it ends up being siloed in either dashboards or within specific departments.

- Customer feedback follow-up is suffering in this industry (only 42% do this).

Like the ecommerce industry, financial institutions rank high in comparison to other industries included in the Benchmark. But that doesn’t necessarily mean they’re done growing. The industry still has a lot to learn when it comes to managing their feedback data successfully – especially as it pertains to spreading the insights across the organisation and following up with customers.

Curious how other organisations in the financial services industry are doing it? Check out how leading organisations such as Allianz and Robeco stay ahead of the curve with Mopinion.

The future of the financial services industry’s digital CX

Respondents believe there will be much more growth in the area of digital CX, especially with the digital disruption taking hold of the industry. In fact, organisations suspect that with operations becoming more automated, the finance industry will double down on business insights and service.

‘Short, concise, rewarding and most importantly engaging’. That’s what attracts these organisations and why shouldn’t it? Engagement – in particular – is a great way to maintain a loyal customer base and keep customer satisfaction levels high.

Like the ecommerce industry, financial organisations also believe that there will be a lot to learn from emotional responses gathered from customers and prospects. There are high hopes that this type of consumer data will help guide them in creating a more humanised and customer-friendly experience across their digital channels.

Curious how other industries scored in the report? Be sure to get your free copy below.

Download the full Benchmark report!