Historically, financial institutions such as banks, insurance providers and investment firms leveraged mainly offline touchpoints and customer interactions, such as meeting with an advisor at a physical office or making an appoint to open up a new bank account. However, due to the widespread digital disruption within the Finance industry, this focus has since shifted. These same institutions are now focusing on two things: the quality of the experience and creating a connection in an online environment. As a result, the Online Customer Journey among Financial Institutions has notably evolved over the last few years.

Luckily, this transition to a more digital way of working has – in return – given financial institutions the opportunity to get even closer to their customers than ever. The question is, what do these customer journeys look like and how can digital feedback play into the process of enhancing them?

This article will analyse what the online customer journey within the financial industry looks like, and how organisations within this industry can leverage digital feedback to optimise various stages within the journey.

When compared with other types of customer journeys, the financial journey is exciting because outcomes are tangible and measurable. For brands like Starbucks or Audi, self discovery and aspirational goals are merely associated with the brand, whereas in financial services, the tools of self discovery and achievement are the services themselves!

Stages of the Customer Journey in Finance

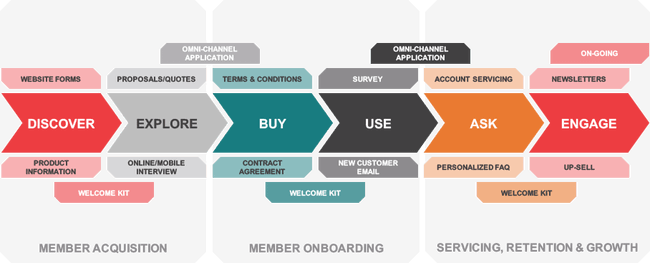

From a general perspective, if we were to breakdown the customer journey in the finance industry, the journey might look something like this:

Source: Intelledox

Note: no single journey is the same…

It’s important to point out that taking a closer look at the online journey in the finance industry can be tricky, as this industry comprises a wide variety of organisations and providers that offer differing online products and services. However, coincidentally many financial organisations also share a lot of the same online processes (i.e. online forms, FAQs, MyAccounts) and online journeys. That being said, we will take a closer look at each stage of the customer journey, illustrating various organisation-specific examples as we go.

Free White Paper: Digital Feedback and the Finance Industry

A guide about how financial institutions can collect feedback on their digital channels and the digitising Financial Industry.

1. Discover

This is essentially the stage in which your prospects are discovering their options. Financial organisations may reach out to their customers via advertising tools and campaigns on social media. However, the more effective option is to offer the information your prospects are looking for, whether that is via search or on comparison sites, etc. This is a key stage as this is where companies must get the audience’s attention and show them the value added in choosing your brand.

2. Explore

Now that the user is familiar with your brand and is aware of which products/services you offer, they will start performing more in-depth research. In this stage, it’s therefore critical that you provide clear and digestible content on your website and/or mobile app. Clear product or service descriptions, checklists and package comparisons go a long way in helping your prospects evaluate their options.

Organisation-specific examples:

In the insurance industry, most customers will first seek advice regarding products or policies. This is done via resource articles, FAQs and online tools (i.e. major US insurance provider Allstate’s ‘Rent vs Own Calculators’ or its ‘Homeowners Insurance Quiz’). When they’ve obtained the information, they’re likely to further evaluate items such as policy coverage and premium quotes and compare this with various other insurance providers.

In online banking, this stage includes research into products/services such as new accounts, loans, mortgages, insurance or credit cards. Given the amount of banking choices today, it is imperative that banks have the information their prospects are looking for readily available. For example, on the website of TSB, a large bank in the UK, there is a lot of content around account types such as ‘Classic Plus’, ‘Classic’, ‘Silver’, etc. These content pages are a great example of the information prospects are looking for. In order to be competitive, these pages need to be fully optimised.

Given the depth of banking choices consumers have today, particularly among more commoditized services like checking, savings and even some types of loans, knowing the customer’s process from start to finish is hugely important.

How can you optimise this stage with digital feedback?

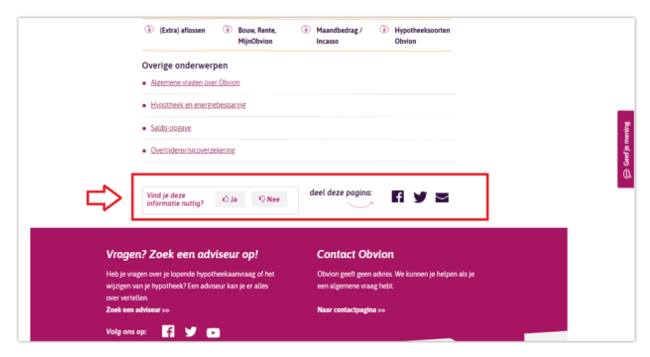

In this stage, the most effective form of digital feedback is website content feedback. This is typically found on websites and mobile apps in the form of a feedback button, embedded right on the page or using any number of triggers to prompt a feedback form.

Source: Website Content Feedback in FAQ section of the Obvion website

This type of feedback helps you discover if the content you’ve provided is helpful for your customers as well as on which pages your customers are struggling to find the information they need.

Typically with these types of surveys, it’s good to keep it short. You can start by asking (depending on the page), ‘Was this content useful for you?’ or ‘Does this information answer your question?’, followed by an open answer field where you ask for an explanation to their previous response.

3. Buy

Next up is the actual purchase or sign up. Whether that is opening a new account or signing a contract agreement, this is an important stage because it will require you to provide an easy transition from exploration/research to becoming a customer. As this is the beginning of customer onboarding, you’ll also want the user experience to be in tip-top shape so as not to discourage customers from converting.

An organisation-specific example

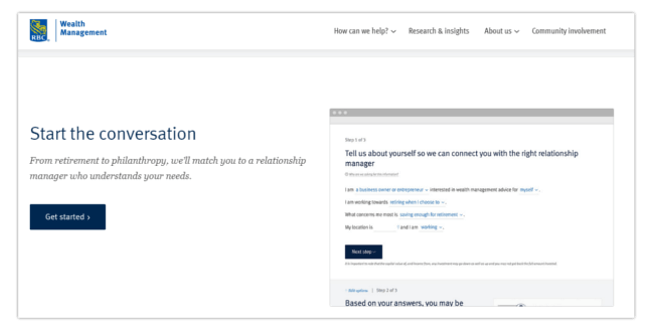

Investment firms, like other organisations in the finance industry have a goal of helping their customers understand their services / products using content on their website or mobile app. However, when the prospect has exceeded that stage and wishes to open an account, or in this case open an investment fund, it’s important that the process is a smooth one.

Example of registration form used by RBC Wealth Management.

A lot of times, to open up an investment account, the user will have to fill in a form with their personal details. During this step, many organisations lose potential investors due to flaws in the user experience (UX) of their form or sign up page For example, perhaps the visitor cannot complete the form due to a technical error or a particular option is not available. These little blunders can cause your customers to give up on the process and drop off.

How can you optimise this stage with digital feedback?

There are lots of ways to correct or optimise within this stage. One of the most widely used methods is measuring Goal Completion Rate (GCR). Using a survey like this, you can find gaps in your UX that are preventing customers from reaching their goals. A lot of times, these will be triggered by certain actions of the user, enabling the survey to appear right when the customer might be considering leaving the funnel. Learn about this type of survey here.

Example of GCR feedback form on the Robeco website.

Alternatively you can employ a survey measuring Customer Effort Score (CES). Customer Effort Score is a popular metric that measures how much effort it took the customer to achieve his/her goal. So for example, if your visitor struggled to move forward with sign up because they were unable to upload a document or fill in a field, you’ll be the first to know. Learn more about this type of survey here.

4. Use

Congratulations! You have a new customer. In this stage, the customer will complete the onboarding process and it is up to the organisation to make sure the customer is all set up. This is your chance to foster quality customer interactions, by providing personalised and relevant interactions.

This is usually done by sending out welcome emails or instructional emails with further details on how to get set up.

An organisation-specific example

With pension providers, for example, there are quite a few onboarding emails going out to users post-purchase or post-sign up. There is the confirmation of sign up, then the first welcome email followed by emails with requests for missing information, as well as instructions on how to continue setting up the account or set up your monthly deposit/investment.

Example of a pension provider’s welcome email.

How can you optimise this stage with digital feedback?

What many organisations fail to recognise, however, is that email campaigns serve as a great touchpoint for gathering insights from the customers. This holds true for onboarding emails as well as campaigns later on down the line.

Email campaign feedback can provide you with insight into whether the content was relevant for your audience, whether it was useful and if there are any gaps in the information provided. You can collect this feedback using a simple, embedded feedback survey within the email.

![]()

Here are a few survey templates you can try out in your outgoing emails.

5. Ask

Now we transition into the customer service stages of the journey. In this stage, it is critical that you focus on making sure the customer remains content with the service and finds information they need when they need it! This is the stage where customers are likely to consult FAQs and other online (self-service) services.

Organisation-specific examples

In the banking industry, self-service – in particular – has become a major trend. In order to reduce costs and optimise efficiency, many banks are starting to depend more and more on digital self-service, especially within their mobile apps. Digital self-service enables customers to carry out banking activities on their own, from checking and account details to paying off bills and clarifying product information.

Source: ABN Amro

Growing customer expectations entail that financial service providers should be able to digitally manage a growing list of increasingly complex processes, such as loan approvals, compliance requirements, customer authentication, and secure access. This entails that the current and growing dominance of transitioning to mobile-based digital self-service becomes key to success.

This also includes providing FAQs, both on the website and in-app. With this kind of information, it is critical that the content is clear and provides value for the customer.

The same goes for the investment industry. On top of your standard digital services like opening an account or checking account details, investment firms have to take this one step further. For example, when customers are about to make an investment decision, which can be quite complex. It is, therefore, important that the information these investors need is readily available when and where they need it.

We want to make investing accessible and understandable to everyone. Not only can you start with a small sum and gain access to specific markets, but we also offer information and tools to make responsible investment decisions. Educating our customers to understand their risks and opportunities to reach their goals. Of course in an easy way (seamless experience). Therefore, we are focusing on providing self-service and online assistance when and where our customers need it

Robeco

How can you optimise this stage with digital feedback?

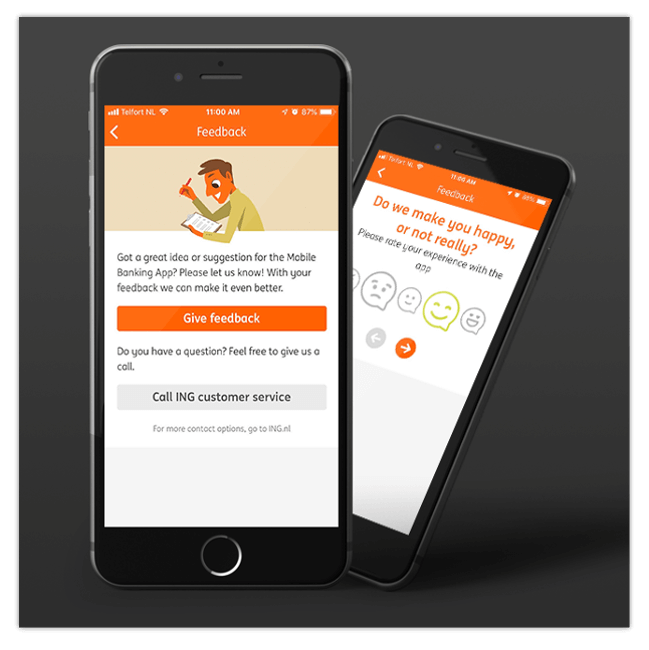

In this stage you can leverage digital feedback to monitor these self-service pages and elements within your mobile app. Whether that is via an embedded [website content] feedback form at the bottom of an FAQ page, or perhaps with a Goal Completion Rate (GCR) survey. The latter is ideal for measuring how successful your visitor was in completing his/her goal on your website or app.

Here are some mobile app survey templates that may help you get started.

Source: Feedback form within the ING Banking app

A Note on Mobile Feedback:

There are three different ways to collect mobile feedback, including via webviews, APIs and SDKs. However one method, in particular, which happens to be on the rise is the mobile SDK. Mobile SDKs offer several different advantages in terms of implementation and usage, such as enabling users to easily make changes to a mobile feedback form (without releasing a new version of the mobile app). It also involves much less legwork which frees up time for developers. Want to learn more about collecting feedback via mobile SDKs? Click here.

6. Engage

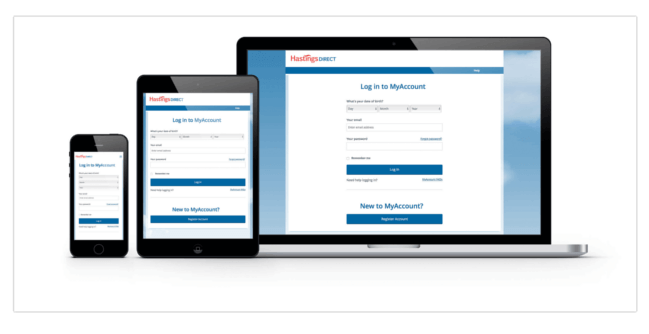

Lastly, we have the engagement stage. This is essentially ongoing engagement that the organisation has with its customers after they’ve signed up. In this stage, contact with the customer may come in the form of service emails, newsletters, up-selling, or more support-related communications such as resolving online issues. It can also take place in the MyAccount portal, a feature which many financial organisations of all sorts share. Here it is important that customers can find important account information, make payments, edit account details and more.

Organisation-specific examples

If we look at insurance websites or mobile apps, the MyAccount portal is often used for reviewing current information regarding healthcare costs, submitting declarations, reviewing healthcare costs, checking up on the financial overview and more.

Source: Hastings Direct

How can you optimise this stage with digital feedback?

Based on what we’ve mentioned above, there are a few ways you can optimise this stage with feedback. One is by applying email campaign feedback to all outgoing emails (whether that’s service emails, update emails, newsletters, etc. It’s important to make sure your customers can notify you if something isn’t clear or they’re not happy with your service. You can use the standard the embedded form for all emails (as mentioned previously), as well as Net Promoter Score (NPS). This is a loyalty metric that’s great for measuring how likely your customers are to recommend your brand.

With MyAccount pages (on both websites and in-app), it’s important to always have a feedback button readily available so that your customers can provide feedback on bugs, page errors, missing information and so on.

Is your organisation using digital feedback?

Time to face the music…no matter how mature your website or mobile app is, it is almost inevitable that there will be some ‘hiccups’ along the way for some of your customers. And the most effective way of discovering those hiccups and correcting them is through digital feedback.

As we outlined above, the online journey in finance is a complex one, consisting of several Moments of Truth (MoTs) and critical touchpoints that vary from organisation to organisation. These are moments in which the customer forms an impression about the company; moments such as searching for information regarding policies, requesting quotes, or asking for advice on a certain service package. For a smooth on-site or in-app journey, these particular moments must be effortless for the customer. In other words, these are key moments to collect feedback from your visitors.

And keep in mind – customers are looking for real-time engagement with financial organisations throughout the entire process, so meeting their needs in-the-moment is critical to your success as well as their continued loyalty to your brand.

Ready to see Mopinion in action?

Want to learn more about Mopinion’s all-in-1 user feedback platform? Don’t be shy and take our software for a spin! Do you prefer it a bit more personal? Just book a demo. One of our feedback pro’s will guide you through the software and answer any questions you may have.