According to Mopinion’s recently published Digital Customer Experience Benchmark report, the ecommerce industry is performing quite well in terms of overall Digital CX management efforts. Coming in second, only to the software industry. In fact, the ecommerce industry has measured itself as particularly strong in measuring digital CX with nearly 67% stating that they always (or almost always) collect digital user feedback. But what about the stages following data collection? How often do these organisations actually take action and act upon insights they’ve gathered? And just how successful is this industry?

The benchmark measures all facets of the digital experience management process (including management and mastery), so let’s explore what this year’s report reveals about the ecommerce industry in 2023. But before we get started, let’s take a closer look at what the Mopinion’s Digital Customer Experience Benchmark is.

The Digital Customer Experience Benchmark

The Digital Customer Experience (CX) Benchmark 2023 report is a report generated by Mopinion based on extensive survey research within the global market. It measures the level of activity around digital CX among organisations all over the world using three main dimensions: Measure, Manage and Master.

- The Measure dimension zooms in on how organisations collect feedback via digital channels such as websites and mobile apps.

- The Manage dimension measures what organisations do with the collected feedback. In other words, to what degree organisations analyse and report the feedback within their team or to the board.

- The Master dimension measures how well organisations take action on their feedback (to improve the organisation on a continuous basis).

*With a focus on the digital side of customer experience management, the benchmark does not include any data about ‘offline or traditional’ customer experience initiatives. It refers solely to the activities that take place across digital channels and touchpoints such as websites, mobile apps and email campaigns.

Average Scores per Dimension

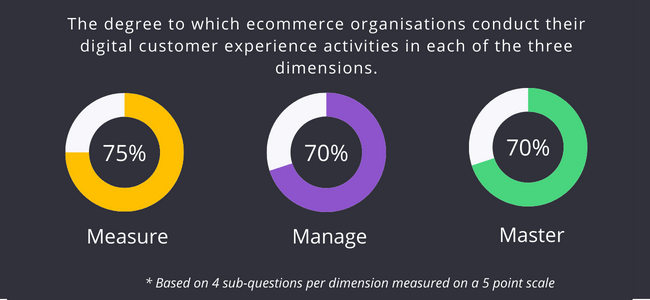

Curious how the ecommmerce industry scored overall – across all dimensions? Here’s a quick glimpse.

As you can see, the first dimension ‘Measure’ scores a bit higher (75%) than the ‘Manage’ and ‘Master’ dimensions (both 70%). What’s causing this added confidence in the data collection stages, and why is there a dip in the analysis and follow up? Let’s dive in…

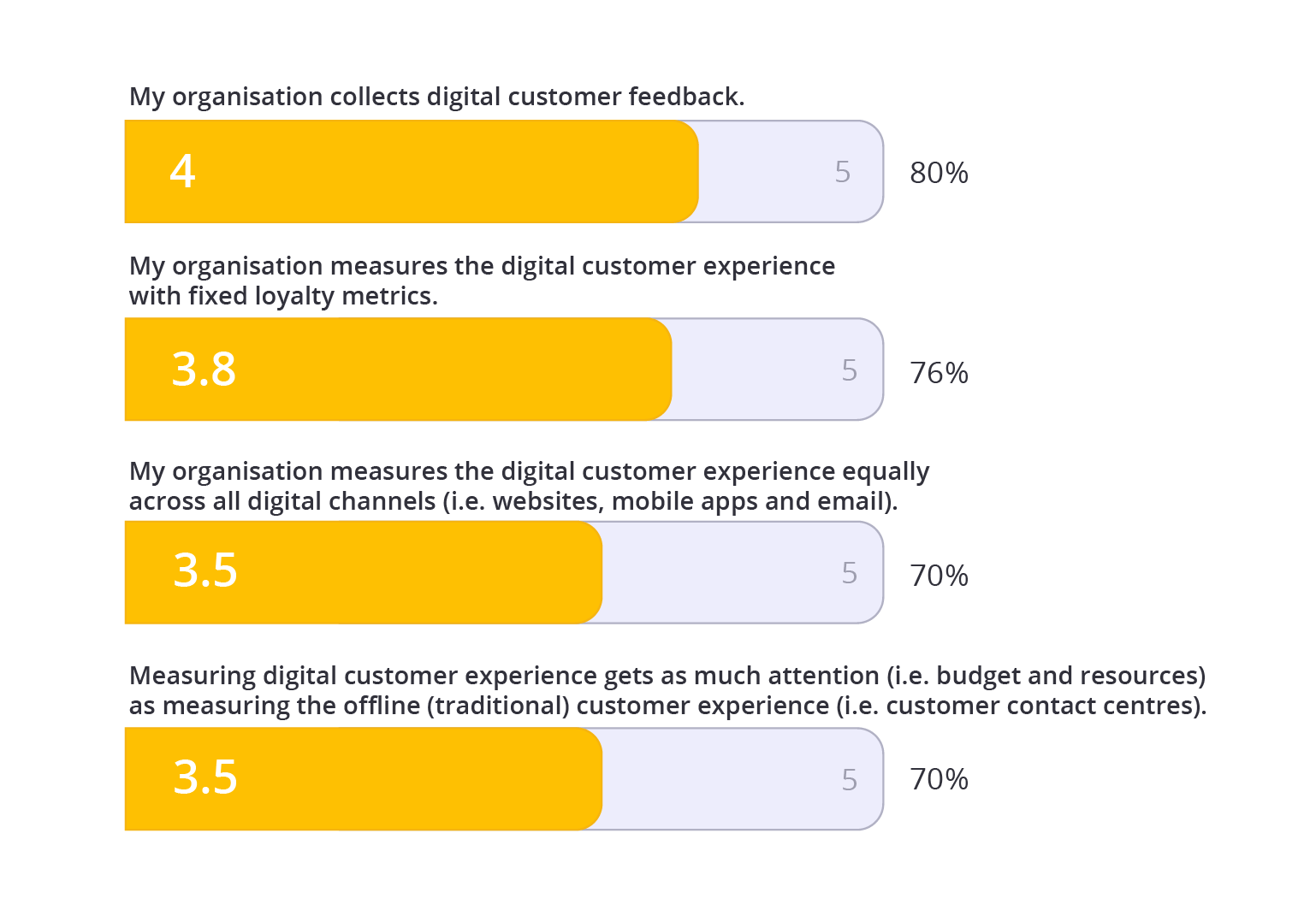

Measure

When it comes to measuring the digital customer experience, the ecommerce industry scored quite high. In fact, its overall scores lined up evenly with those of the finance and travel industries. The only industry that scored higher was software.

So what does that mean for the industry? We can only conclude that this means the ecommerce industry is on track towards becoming a leading industry in digital customer experience. However, there are still some challenges that lie ahead.

While the scores for the collection of digital feedback and usage of loyalty metrics appears to be widely used, there are cracks in other areas of measurement including the extent of digital channels being measured as well as the amount of attention given to digital initiatives compared to the more traditional ones.

One might even speculate that the reason for digital CX not being measured equally across ALL digital channels is that there is still a heavy focus on the website alone. And why is this happening? We answered this question in our previous post about measuring feedback equally across all digital channels:

Digitally speaking, the website has always been the go-to channel for attracting and retaining customers, maintaining search engine rankings and presenting new information, products and services to customers and prospects. It makes sense, really. It’s within our comfort zone and it’s always proven to be a good platform for business. But times are changing and the customer is no longer using the website alone to reach his/her online goals. In fact, mobile apps are climbing to the top in terms of popularity, especially among ecommerce businesses and the financial sector. And then, of course, many businesses are still using email campaigns to further their marketing efforts.

As for the digital versus traditional comparison, the higher allocation of efforts towards traditional experiences is likely attributed to the ongoing struggle ecommerce companies are having with trying to achieve ‘omnichannel’ status. In other words, they haven’t yet found a happy medium between seamlessly aligning digital interactions with customers and physical interactions in the store. Additionally, this trend could be the result of a lack in expertise. There are quite a few CX specialists who have yet to recognise the power of measuring digital CX and therefore only focus on the traditional experiences.

Looking for ways to improve your digital CX using customer feedback?

Try these ecommerce surveys and get your digital marketing strategy back on track!

Manage

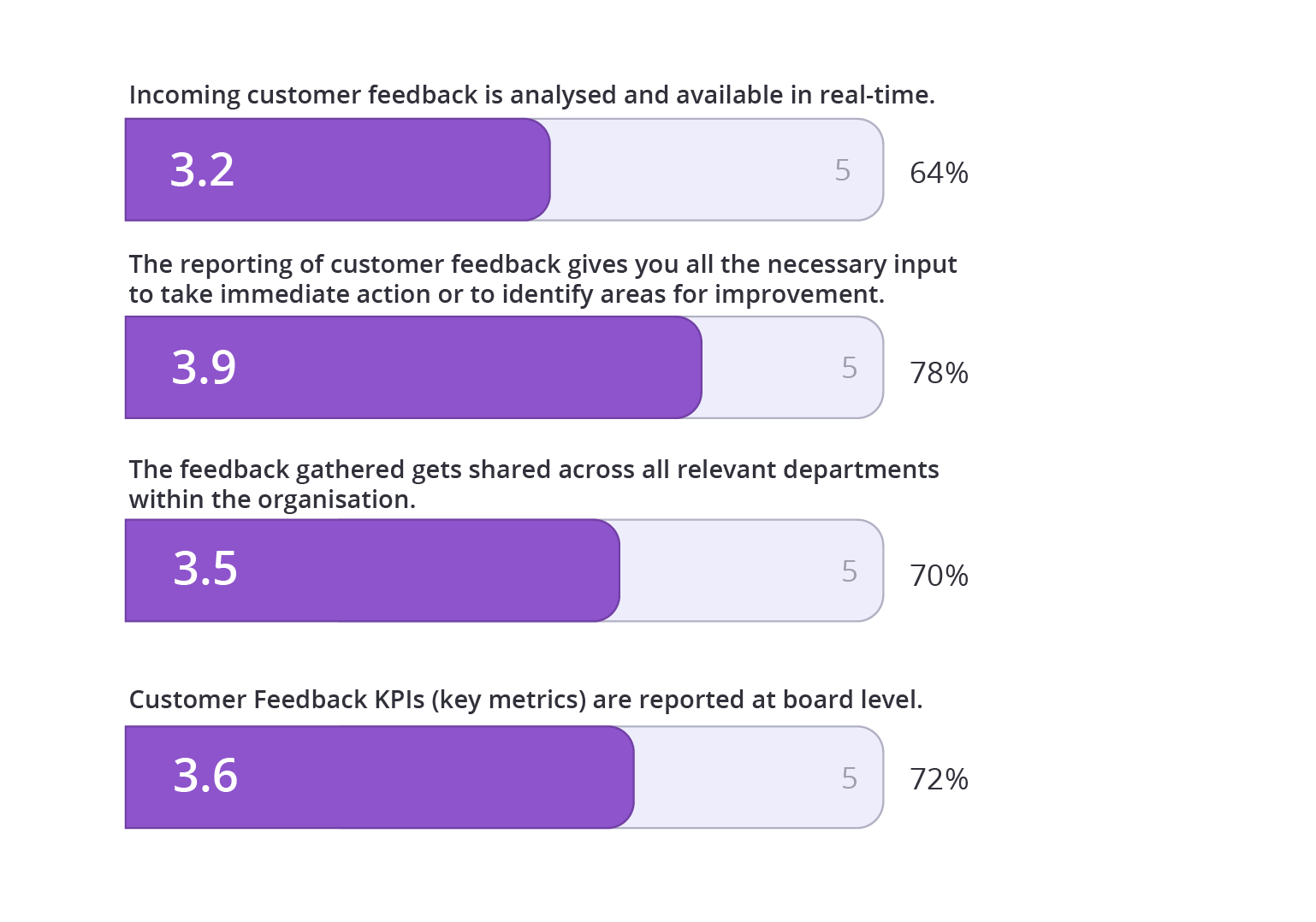

Managing digital customer experience data, however, is another story in ecommerce. Across the chart, scores are a tad lower than in the previous Measure stage. Let’s take a look at what’s happening…

The most noteworthy score in this dimension is the score ecommerce organisations gave themselves for the analysis and availability of real-time feedback: a 3.2 out of 5 (64%).

On the lower end, this score indicates that despite the enthusiasm and widespread data collection efforts indicated in the Measure phase, ecommerce organisations are falling somewhat short when it comes to making sense of the incoming data. In fact, just 46% of respondents answered that they ‘Always or ‘Almost Always’ analysed their feedback.

What’s also interesting is that 70% of respondents believe that reporting customer feedback gives them all of the necessary input to take action and make improvements. So why isn’t the analysis initiative more prevalent among ecommerce organisations?

A possible explanation might be that organisations find it difficult to analyse and report on qualitative data, i.e. human emotions and conscious/unconscious decisions). Clustering and making sense of this soft data can be challenging without the right solution.

Master

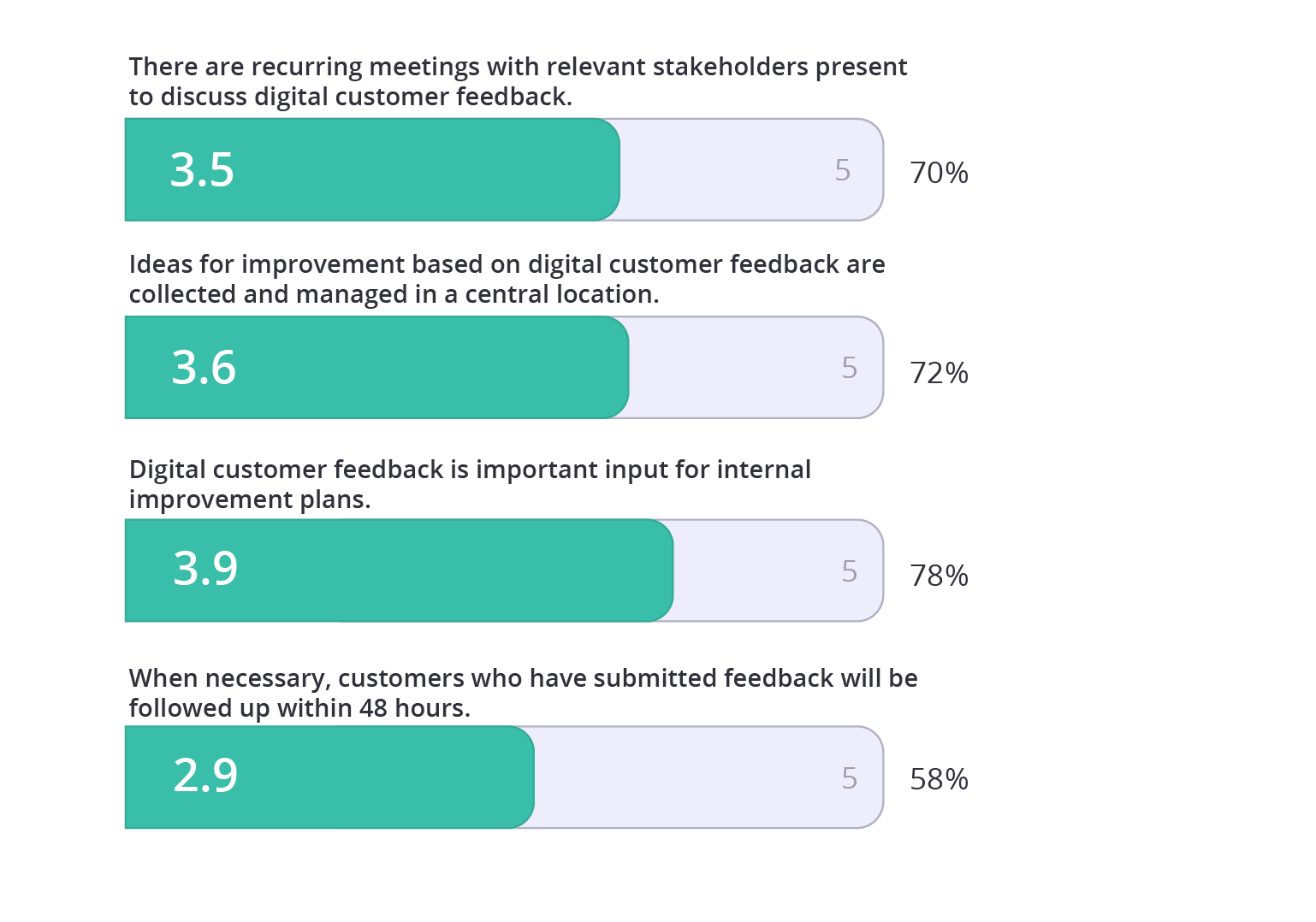

Overall scoring for this dimension was comparable to the Manage dimension in many ways. However, there were some interesting findings here.

What stood out here? For starters, the low 2.9 out of 5 average (58%) that ecommerce companies gave regarding following up on feedback within 48 hours.

According to LinkedIn,

60% of customers feel as if their concerns are not being addressed by companies

In a world where customers tend to choose companies with which they feel a connection, this action is extremely important, and therefore definitely an area of improvement for many ecommerce companies. So what’s holding these organisations back from following up? Are they failing to listen to the incoming feedback? Are they asking feedback at the wrong time or place and therefore deeming the feedback irrelevant to their online goals? Or do they feel they lack the resources to do this? For many organisations the latter is typically the root cause. With so many feedback items flowing in, it can be overwhelming – especially for ecommerce giants – to cater to all of their needs individually. That is why a feedback software with a strong analysis and follow up solution is critical.

It’s also interesting to see that organisations reported that customer feedback is really important for internal improvement plans. This is a promising and inspiring opinion as this means that the initiatives are valued, just not yet fully implemented (in some cases).

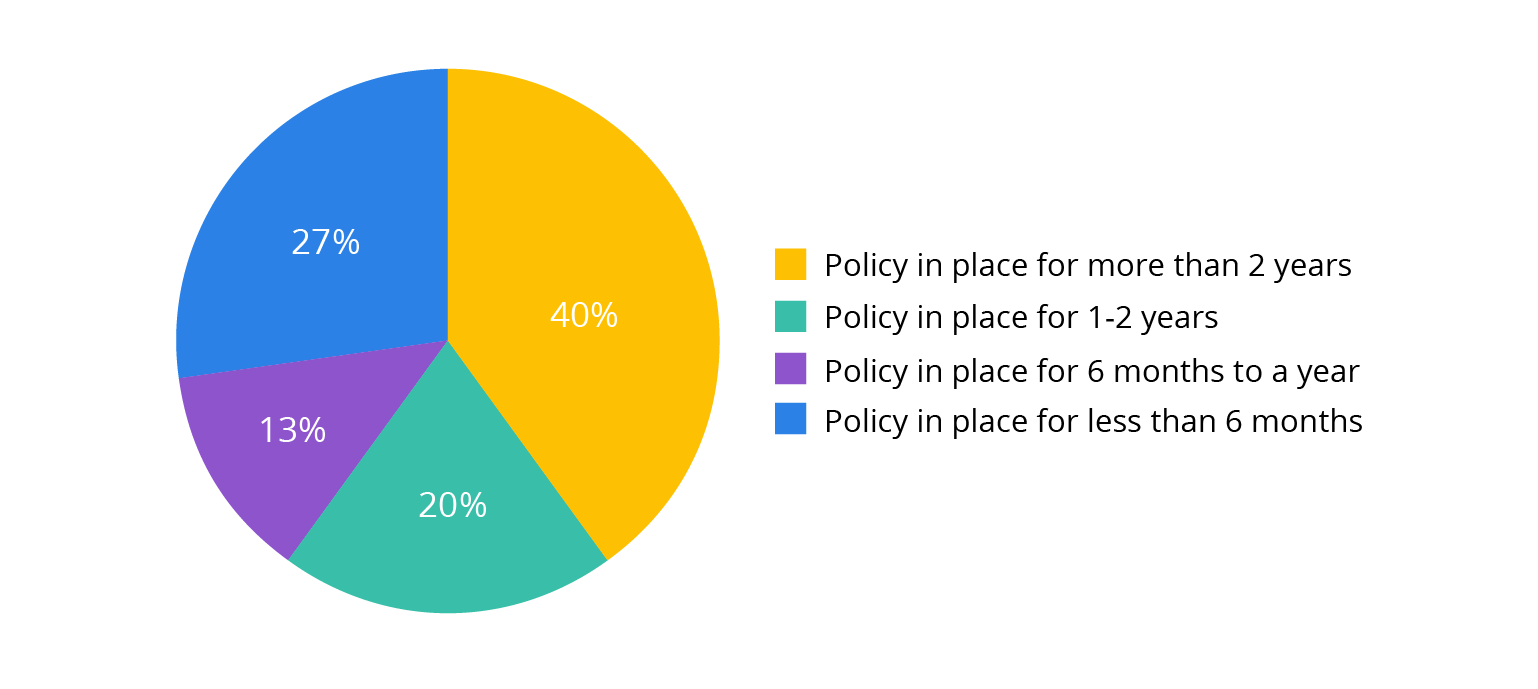

How many organisations already have an active Digital CX policy in place?

With nearly 80% of respondents having an active policy in place for their digital CX efforts, there seems to be a healthy amount of enthusiasm in the industry. Especially if we look at the 27% of organisations that have likely just implemented a new policy this past year.

It will be interesting to see how this changes between now and 2024, as digital initiatives continue to rise on the agendas of ecommerce organisations.

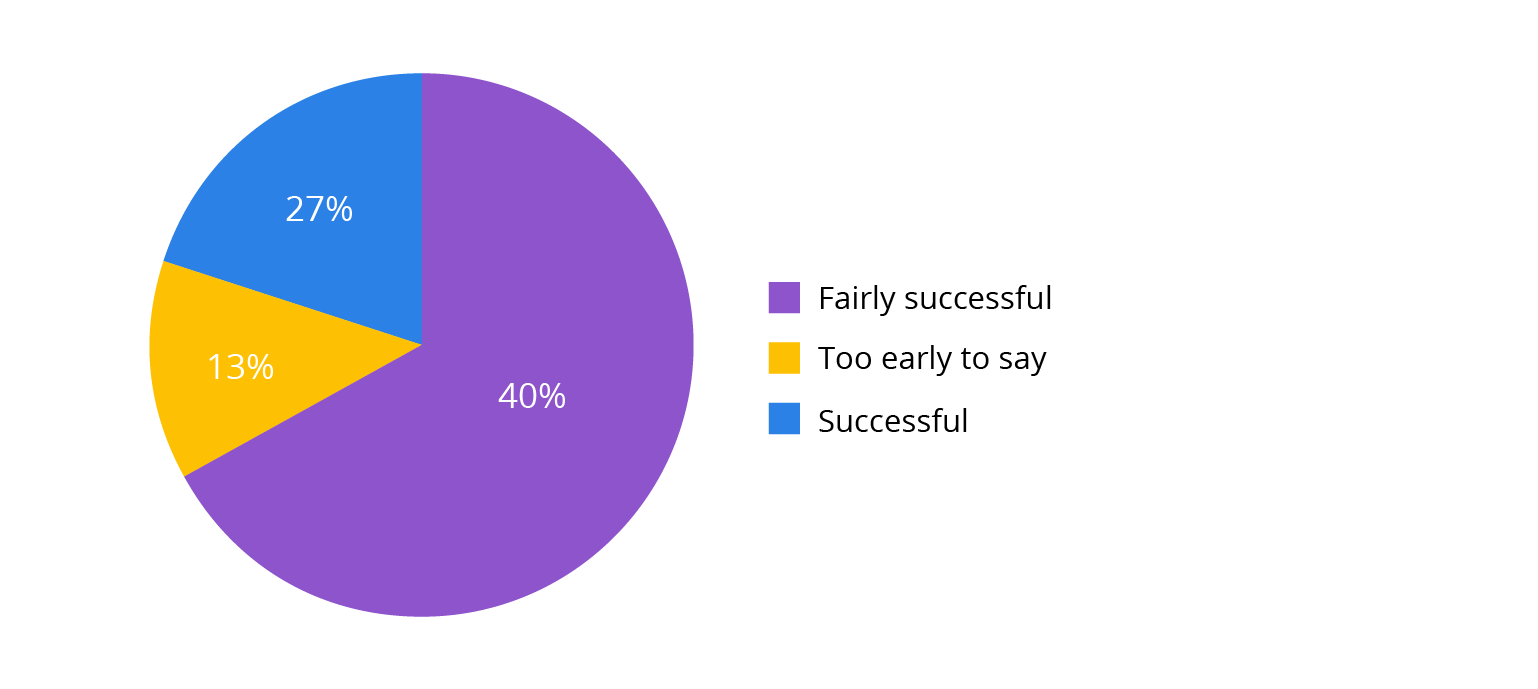

How successful is the ecommerce industry in terms of Digital CX?

Pretty successful, actually! At least that is how they see it. In fact, 86% of respondents said that they were ‘Fairly successful’ or ‘Successful’. This indicates that the majority of ecommerce organisations are quite content with the way in which they are managing their feedback data.

This is certainly a motivator for organisations who have yet to break into the digital CX management process.

Key Takeaways for the Ecommerce Industry in Digital CX

- Plenty of organisations are gathering feedback, but lacking the insights from ALL digital channels.

- Digital channels still aren’t getting the same amount of attention as traditional channels.

- Less than half of respondents analyse their feedback data, while 70% believe that the insights will help them with digital experience improvements.

- Feedback is still not effectively being followed up, which can lead to poorer customer loyalty levels.

- 80% of respondents have an active digital policy in place which is a great sign for the future of ecommerce!

- 67% of respondents are ‘Fairly Successful’ in digital CX efforts, meaning there is certainly room for improvement.

As you can see the ecommerce industry is high on the list of industries that are successfully managing their digital CX efforts. However, there is always room for improvement. In fact, a great way to get inspiration for improvement is to look at how other organisations in your industry are doing it! That’s why we’ve written up a nice article featuring the best practices for ecommerce organisations based on the accounts of well-seasoned Mopinion users such as Calvin Klein, Intergamma, Leroy Merlin and more.

As for what the future holds…

According to respondents, there are high hopes that the digital CX will evolve thanks to the possibilities it creates to measure emotional responses. This will be a particularly interesting development for the ecommerce industry as it will guide these organisations in humanising interactions as well as learning more about the motives behind consumer behaviour.

Curious how other industries scored in the report?

Be sure to get your free copy below.

Download the full Benchmark report!