Allianz forms part of Allianz Group which is one of the largest, multinational financial services companies in the world. The organisation has operations in over 70 countries and more than 85 million customers. Originally, Allianz sold its products and services through intermediaries. As a result, Allianz’s website didn’t play a major role. However, nowadays, with so much more business taking place online, the website has become increasingly important to the success of the organisation.

Allianz strives for innovative solutions. But how does the organisation realise this ambition in practice?

Stefan, Conversion Specialist at Allianz, and part of the Business Transformation Unit shares their story,

We want to become the NASA of the insurance industry.

As a Conversion Specialist, the goal is to lead as many visitors as possible from point A to point B, with as little inconvenience as possible. For example, navigating to the insurance pages and reporting damage should be a smooth process. To achieve this, Allianz uses Mopinion’s customer feedback to discover obstacles and rid them from the journey.

Allianz steps outside of its comfort zone

By stepping outside of its comfort zone and not only focusing on the insurance industry, Allianz maintains a strong online position. Allianz grabs its inspiration from successful companies in other branches – such as the popular campaigns of Coolblue – and applies them in the somewhat traditional insurance world. Stefan meets quarterly with other Conversion Specialists (or Conversion Heroes as they call themselves) from – for example – Bol.com, Transavia and Beerwulf to share knowledge and advancements in the field.

A unique online customer journey

Allianz has a wide variety of customer journeys, depending on the type of product. However, while the phases of these journeys are the same in every country, the interpretation of each phase is tailored to local markets.

“The customer journey doesn’t end with taking out insurance. We also try to maintain good contact with our customers afterwards. For example, in case of a damage claim, Allianz is there to get its customers back on track.”

Extracting meaningful insights

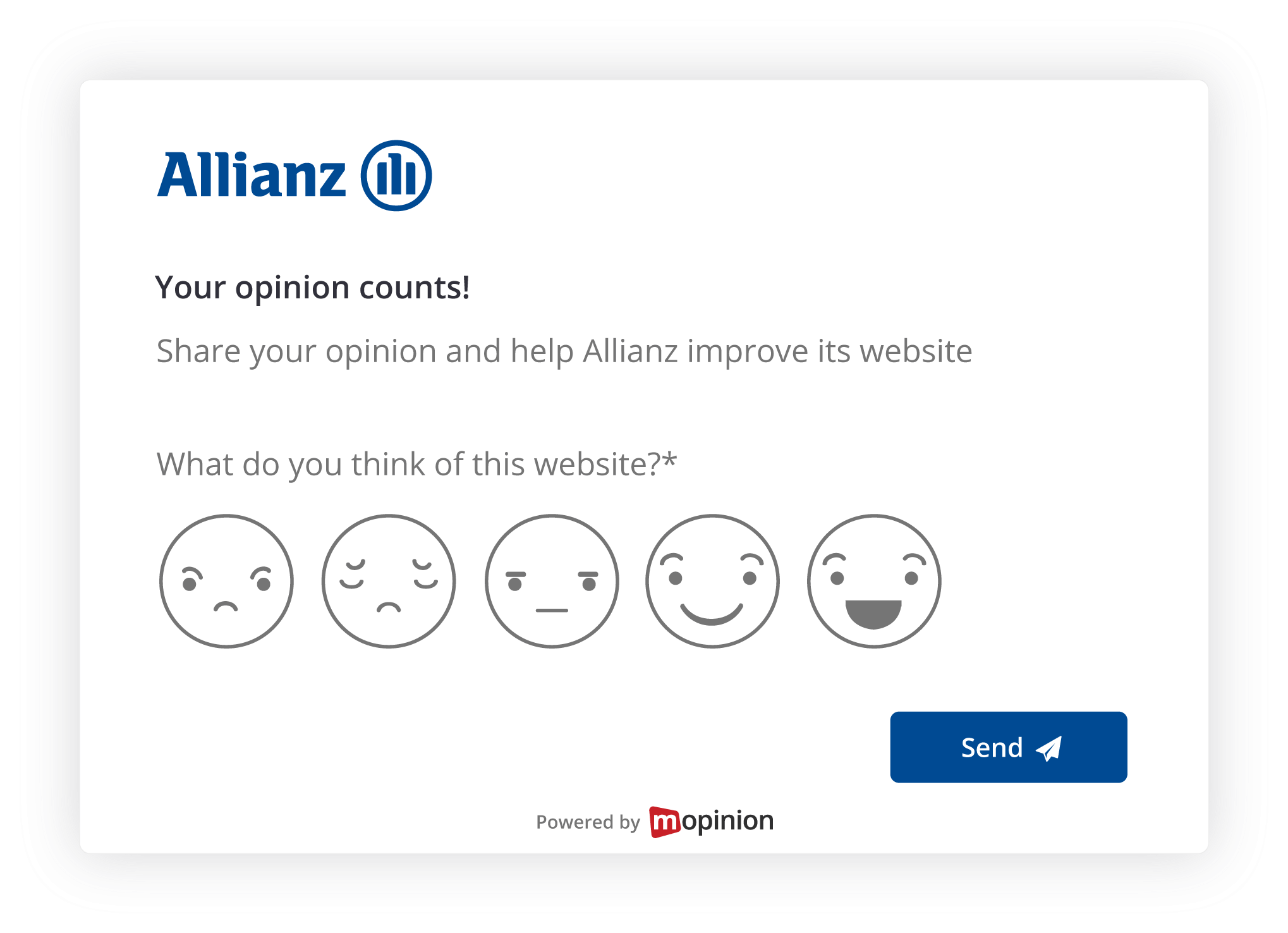

Allianz works with a number of “Blue Principles” when developing new things. One of the principles is that everything must be customer centric. This means that Allianz looks at how its customers experience the website early on in the customer journey. Which areas require extra effort? What can be improved upon in order to optimise the customer journey?

“It is important that we get insights into these areas,” says Stefan.

Free White Paper: Digital Feedback and the Finance Industry

A guide about how financial institutions can collect feedback on their digital channels and the digitising Financial Industry.

To gain insight into how the online customer journey is experienced, Allianz got straight to work using a feedback tool.

“We previously collected customer feedback using another feedback tool. But this quickly became a very time consuming and inefficient solution. For example, if I wanted to carry out a simple task such as changing the colour or style of a feedback form, I had to contact the Customer Success Manager.”

Luckily, Allianz discovered Mopinion, made the switch and has been working with Mopinion for over two years now.

The big advantage with using Mopinion customer feedback is freedom. We can adjust everything ourselves and prepare the feedback forms in our house style. There are no restrictions.

Leveraging feedback for conversion optimisation

Allianz collects customer feedback primarily to discover obstacles within the customer journey. According to Stefan, the great advantage of collecting customer feedback is that you can identify problems that you had not yet discovered yourself.

Stefan talks about a challenge Allianz experience prior to feedback:

“There was a tangle of CMS’s, tools and (sub) domains and it was therefore impossible to quickly identify when a website was not functioning optimally. Luckily, customer feedback is able to quickly bring this to your attention. If something does not work, visitors often let us know via the feedback button that is located on every page and a member of the team will receive a notification and start optimising.”

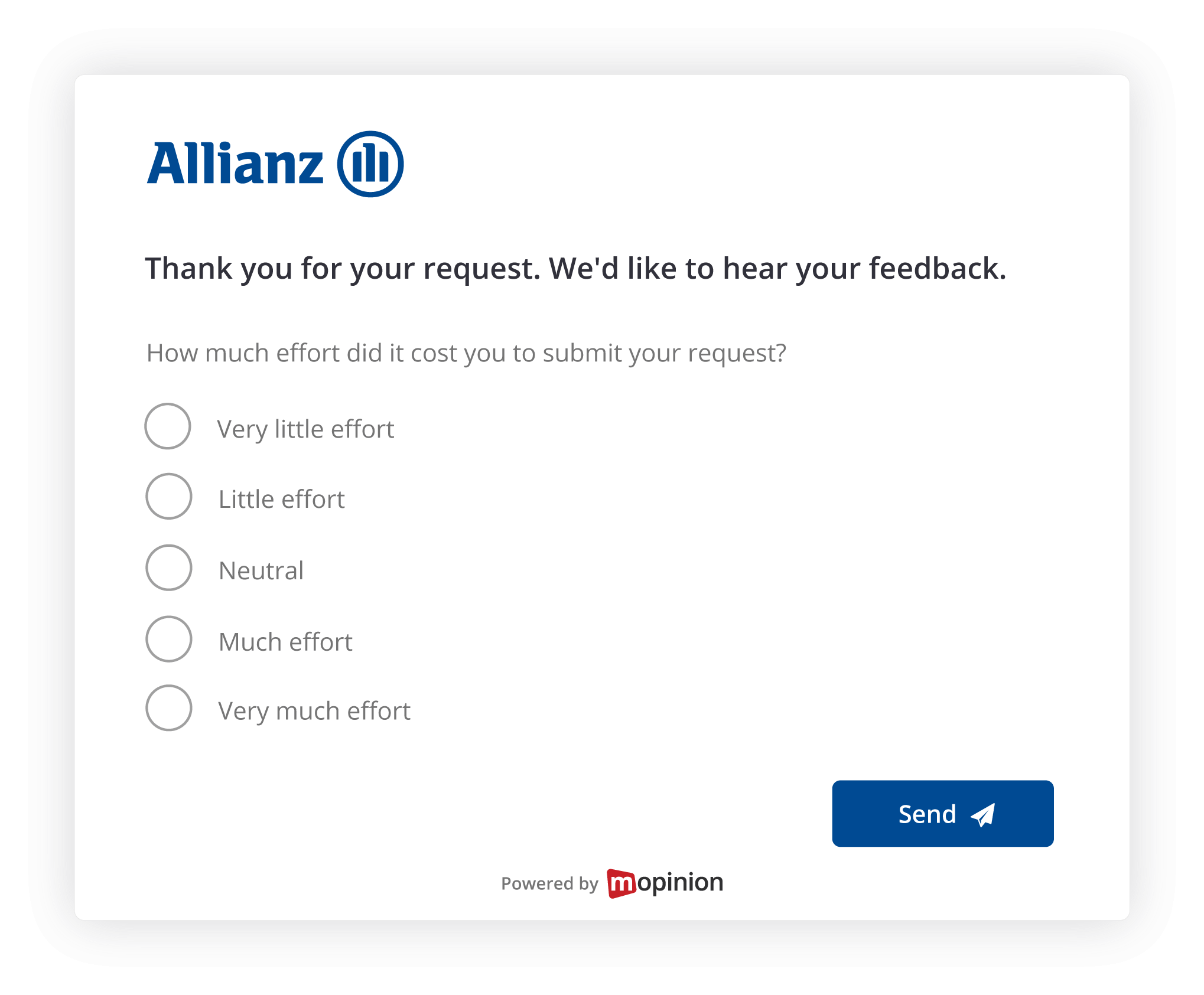

Passive and active feedback on the website

Allianz currently uses passive and active feedback on the website. Passive feedback is feedback collected by a feedback button on the website. The visitors let the team at Allianz know what they think of the website.

To prevent drop offs in conversion, Allianz also collects active feedback via an exit survey. An exit survey is a short questionnaire which asks visitors to share why they are leaving the site or page. Often this feedback form appears just before someone ‘threatens’ to leave the page and moves the mouse towards the exit, or if someone is on a page for a certain amount of time.

With one of the insurance policies, Allianz saw the conversion via mobile was low. Many users clicked on the receipt, but were unable to continue. There was no clickable cross or button, so users got stuck and ended up leaving. Feedback helps Allianz confirm this problem.

We resolved the issue and as a result conversion increased from 0.48% to 3.50%, which translated to more than € 900,000 in additional premium turnover. This goes to show that customer feedback can save you a lot of money.

Stefan van Ballegooie, Conversion Specialist at Allianz

Looking to the future

Allianz is currently looking into where they can use Mopinion feedback and Belgium is first up on the agenda.

“Allianz has a lot of knowledge and experience in the field of customer feedback in the Netherlands and we want to share this knowledge with colleagues in other countries. For example, they do not yet collect feedback in Belgium and we want to change that…”

Allianz hopes to see more and more branches and locations adopting a feedback programme so that they too can reap the benefits and take steps in conversion optimisation.

Want to learn more about Mopinion’s all-in-1 user feedback platform? Don’t be shy and take our software for a spin! Do you prefer it a bit more personal? Just book a demo. One of our feedback pro’s will guide you through the software and answer any questions you may have.Ready to see Mopinion in action?

![[:en]Allianz Feedback Cover Image[:]](https://media.mopinion.com/wp-content/uploads/2020/03/27144929/allianz-cover1-300x108.jpg)