With the migration to digital, many insurance companies are actually experiencing increased friction rather than a smoother online experience. So what can we attribute this to? In most cases, we can blame it on the fact that their digital channels still aren’t sufficiently optimised enough for policyholders to successfully achieve their online goals; a matter which places a heavy burden on customer contact centres. So, whether it’s engaging in automated claims processes, carrying out self-service activities (i.e. updating a policy), conducting online transactions (i.e. purchasing insurance) or even seeking out human interactions, the insurance industry will have to find ways to overcome the looming dark cloud of digitalisation challenges it’s currently facing.

What these organisations don’t know is that the secret to becoming an insurance innovator lies with customer feedback.

In this post, we will look at four different ways in which customer feedback can help insurance companies overcome their digitalisation challenges.

Let’s dive in!

How feedback can help overcome digitalisation challenges

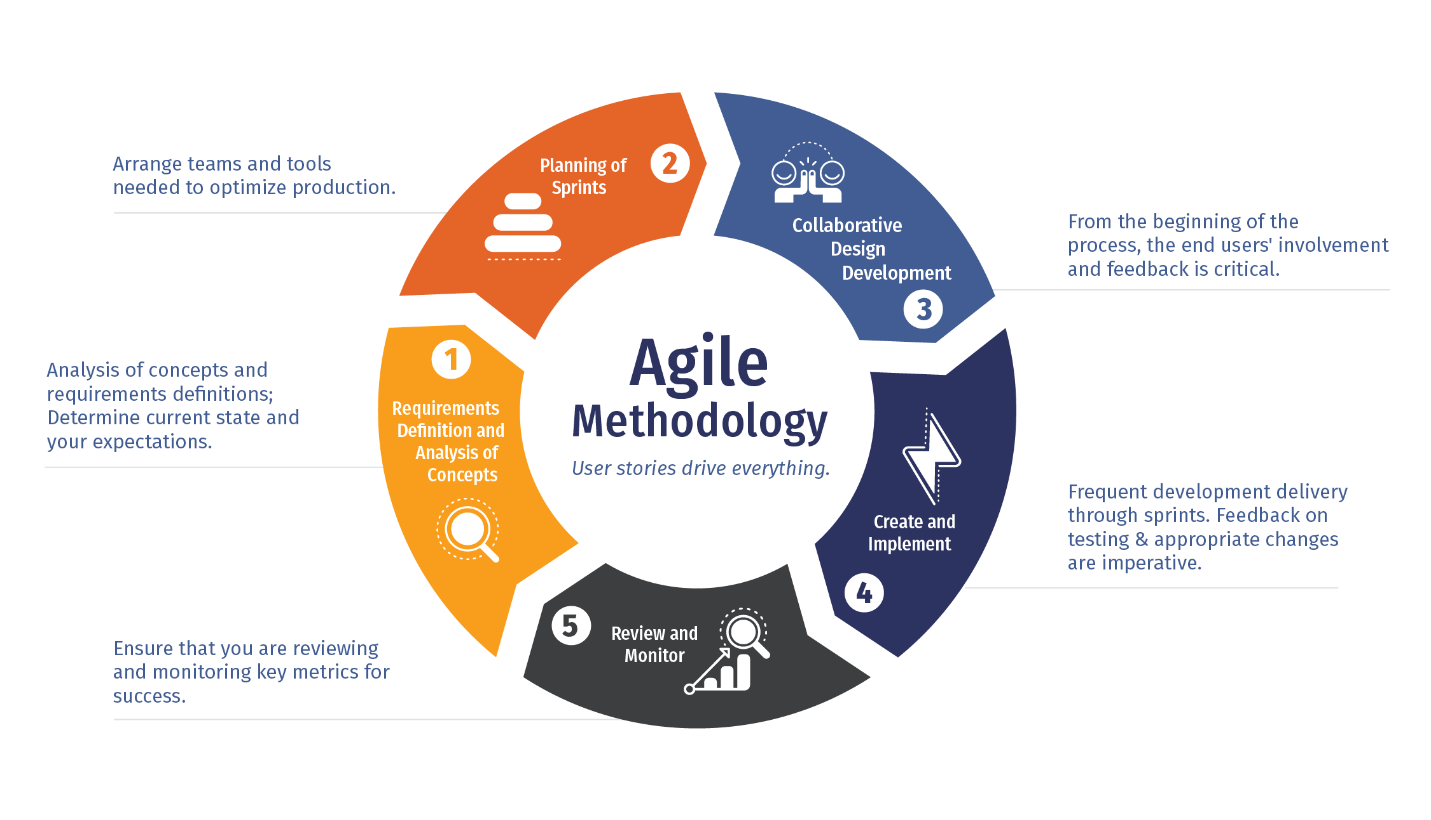

1. Enables a more agile and efficient way of working

The industry is accelerating at a pace that many insurance companies simply cannot keep up with. In fact, with insurtech now on the scene, these companies are finding themselves in a ‘bit of a pickle’ when it comes to providing an experience that their policyholders expect. Not only are these technologies raising the bar, but they’re disrupting the industry through product development and delivery.

According to ResponseTek, the level of satisfaction among consumers with digital services provided by insurers has dropped enormously, and it appears to worsen as the customer travels through the online journey.

For example, research and purchasing are seen as smooth processes, whereas managing policies and claims are a source of dissatisfaction for nearly 70% of consumers.

Hence, the need for a more agile and efficient way of working.

“The concept of enterprise-wide agility is not new; many technology companies and service-industry leaders—particularly those in banking and telecommunications—have adopted it. More insurers are now turning to agile methods as they try to adapt to rapid industry changes.”

McKinsey

Customer feedback caters well to this need. Feedback can ensure digital agility in important online processes by providing organisations with the insights they need to make quick and effective decisions. In fact, many customer feedback solutions on the market – like Mopinion – enable you to gather feedback in real-time and consistently through the deployment of live feedback forms across your most important digital channels.

Some customer feedback solutions are also capable of distributing this data across the entire insurance organisation, giving smaller teams a bigger role in quickly iterating on products and processes. This will prevent these organisations from falling into the traditional operating models that are quickly becoming obsolete, and help them move forward in effectively ‘delayering’ the organisation.

2. Connects touchpoints and provides a cohesive experience

Often perceived as a more traditional industry, the insurance world isn’t as well acquainted with digital solutions as other industries. As a result, their digital channels often lack the much desired (and cohesive) customer experience that their customers seek. That being said, these organisations need to find a way around this stigma and start employing a more digital-first approach. Or at least settle for a hybrid approach that marries both digital and physical experiences.

Insurance organisations generally work with a number of different touchpoints when it comes to customer contact. They leverage email, website content, mobile apps and of course, the more traditional touchpoints like contact centres. However, without the right digital tools in place, the experiences that take place via these touchpoints tend to remain entirely separate.

Customer feedback is an effective tool for giving these digital channels the attention they deserve. It’s also a great way of connecting various digital touchpoints and generating a better overall view of the customer experience.

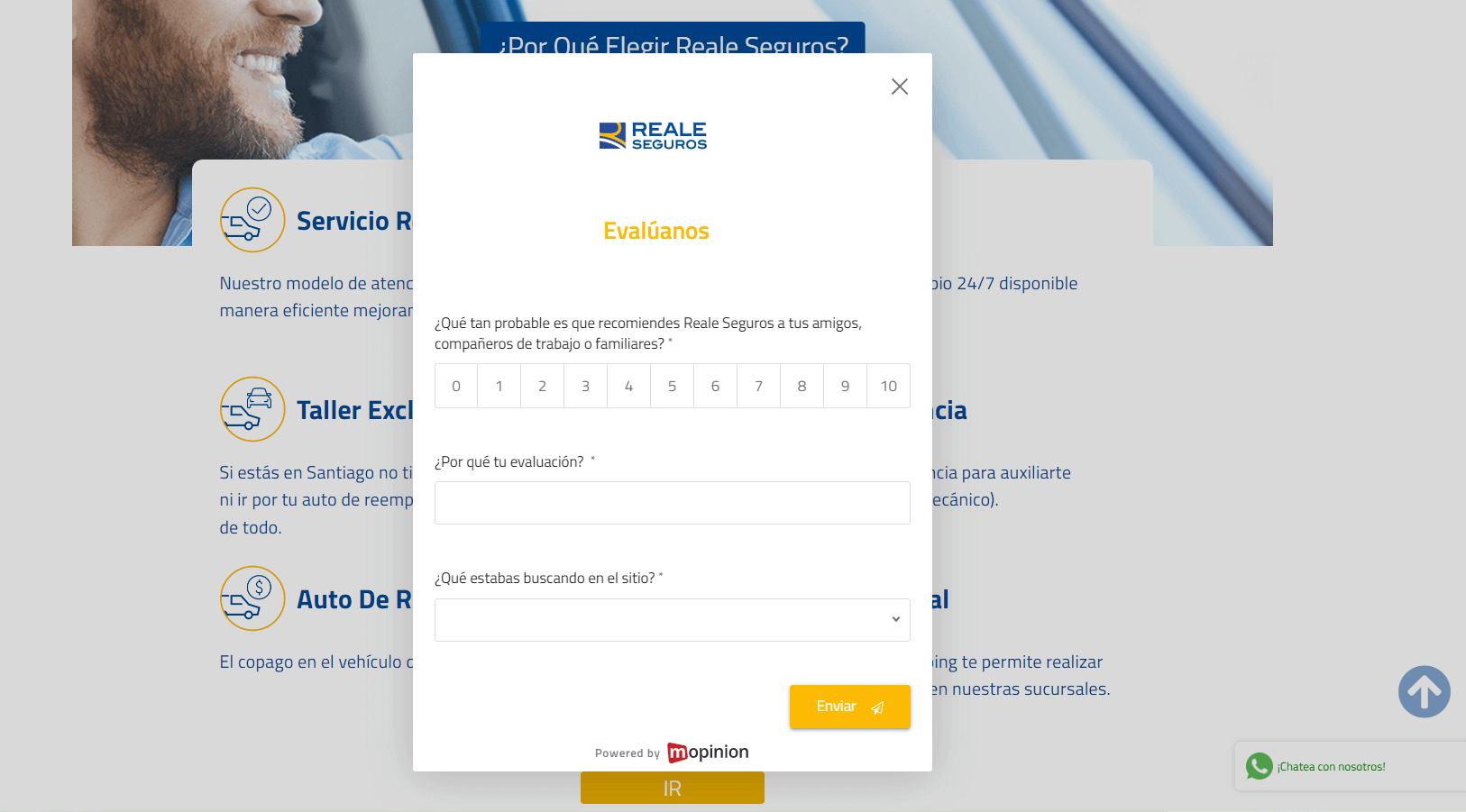

Let’s look at how insurance company Reale Seguros does this with their voice of customer programme.

Reale Seguros leverages feedback in two different ways: on the homepage of its website and within the user portal. The homepage survey is deployed passively, meaning that it is always visible via a feedback button on the side of the page, whereas the user portal survey is deployed actively (appearing around 15 seconds after logging in).

Example of an NPS survey on the Reale Seguros website.

One of their key metrics, Net Promoter Score (NPS), is used across the entire organisation (as well as the Group) and enables Reale Seguros to gather loyalty insights from its existing customers. This is, of course, integrated into their feedback forms.

Be sure to read their full customer feedback testimonial here.

Does your feedback solution offer the right integrations for marrying all of your feedback data together? Be sure to check out the integration options Mopinion has to offer here.

3. Helps insurance organisations become more ‘future-proof’

“Typically, the insurance company supports a legacy technology stack and architecture and has neglected a major overhaul of its technology for far too long”, according to Level.io.

And this actually holds true for a large majority of the organisations in this industry. They’ve been operating on legacy systems for countless years and as a result, it’s all they’ve come to know. However, if these organisations wish to continue attracting and retaining large market segments (with seemingly higher product expectations), they’re going to have to stop, assess and ultimately seek out a more future-proof strategy.

Customer feedback is one such element that can aid organisations in creating a more future-proof online strategy. It’s continuous, it’s human, and it can be used for multiple initiatives, whether that’s product improvement, content optimisation, or even calibrating the user experience.

Continuous improvement

Customer satisfaction and a good customer experience often stem from continuous improvements made to online funnels and web pages, which means your website or app should not be a static medium, but rather something that is changing all the time. By continuously gathering and analysing customer feedback on your digital channels, your organisation can future-proof itself and be ready for any new developments in the market, i.e. new, online self-service opportunities.

User feedback is a powerful tool for improving conversions

See how Allianz unlocks key to conversion optimisation with customer feedback

Humanised approach

More and more customers – especially in the insurance industry – are looking for relatable, personal and human interactions with brands. This means that insurance organisations are going to have to switch gears and cater to their customers on a more personal level if they want to stay ahead of the rest.

The ability to gather qualitative data from your policyholders and prospective customers is a great way of getting more humanised insights into your online experience. Customer feedback solutions such as Conversational Feedback are a great way of doing so. Conversational feedback offers you a way to collect feedback in a more chat-like way.

All-encompassing

Customer feedback is also a great way of making sure all of your channels are performing as they should consistently. Being able to measure customer satisfaction on your website, mobile app and within email campaigns gives you a good overall view of how your policyholders experience your brand as a whole. The insights retrieved from this wide range of data helps you future-proof all of your channels simultaneously and continuously.

4. Helps foster a meaningful dialogue with policyholders online

Speaking of a humanised approach, customer feedback is also a great tool for initiating a dialogue with your policyholders and prospective customers. It also contributes to the creation of a more personalised customer experience.

For example, the claims process is often one of the first interactions an insurance company has with the policyholder. For this process to be a successful one, the insurance company must ensure that it provides the policyholder with a simple and personal experience that helps them reach their goal in one fell swoop. By employing feedback at this touchpoint, the organisation can monitor how this process is experienced by the customer and quickly resolve any issues in a timely manner.

“Although the insurance industry is making progress towards better digital experiences, consumers bring expectations from the outside in. They want customer-centric service, a claims agent who is responsive to them, as well as the same level of ease, simplicity and personalisation that they get on a daily basis from the likes of Netflix, Spotify and Uber. That means the bar is set very high for insurers.

Insurtech Digital

Make the road to digitalisation a smooth one…

All it takes is recognising which tools are needed to bring your organisation from old to new. The need for a smooth digital experience is only going to grow within the insurance industry so now is a better time than ever to start making an effort. And customer feedback is certainly a step in the right direction – especially if that direction points to a frictionless online experience.

Ready to get started?

Ready to see Mopinion in action?

Want to learn more about Mopinion’s all-in-1 user feedback platform? Don’t be shy and take our software for a spin! Do you prefer it a bit more personal? Just book a demo. One of our feedback pro’s will guide you through the software and answer any questions you may have.